Fighting for a future rich in wildlife

Zoos Victoria acknowledges and respects the Traditional Owners as the original custodians of the land and waters, their ability to care for Country, and deep spiritual connection to it. We honour Elders past and present whose knowledge and wisdom has ensured the continuation of culture and traditional practices.

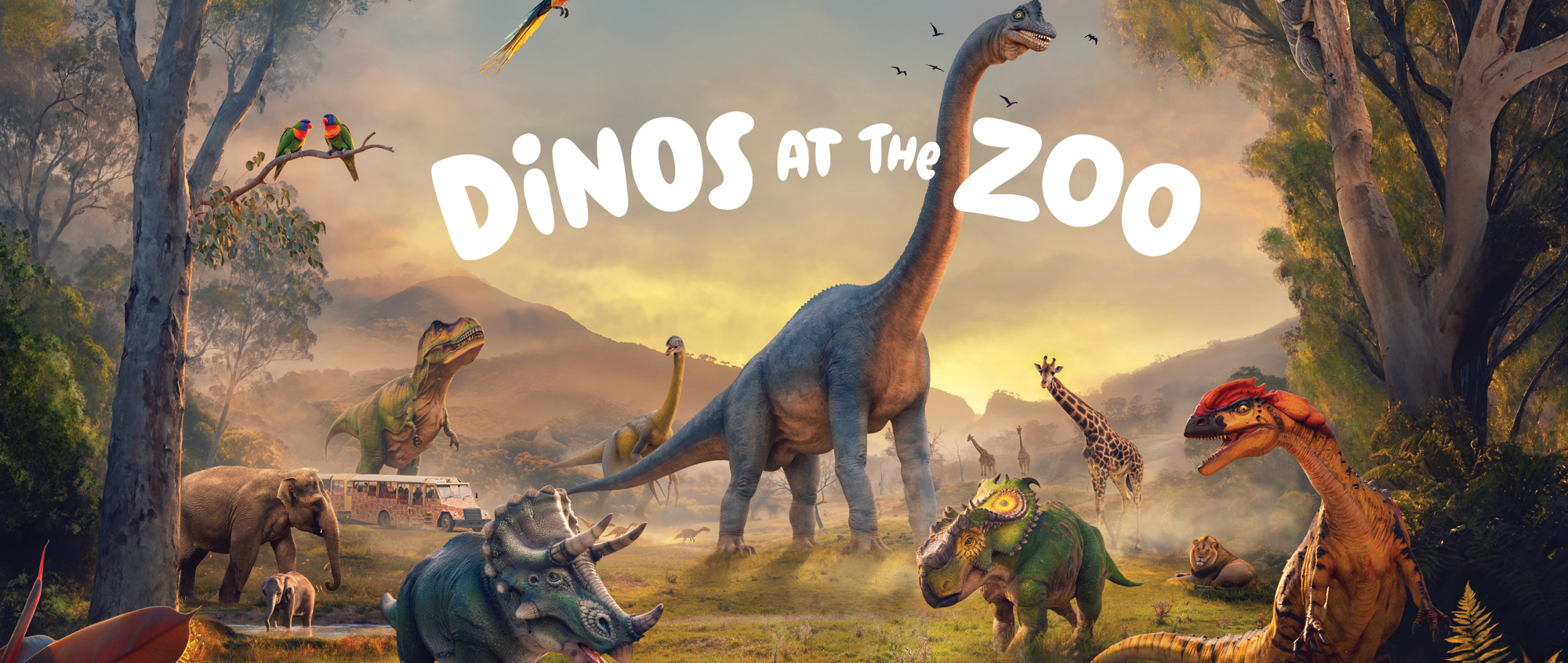

Dinos have arrived!

Get ready for the ultimate dinosaur adventure at all four zoos

Fighting Extinction

Zoos Victoria is committed to fighting wildlife extinction.

Members get more!

Only $11.50 a month over 12 months

Unlimited entry to Melbourne Zoo, Werribee Open Range Zoo, Healesville Sanctuary and Kyabram Fauna Park

Kids join free on adult memberships

Free entry to five interstate zoos

Discounts at the Zoo Shop and from our zoo partners

Help fund our conservation work to fight wildlife extinction

School Programs

Explore Zoos Victoria's Fighting Extinction Schools Program. Engage your students through excursions, digital programs, teaching resources, and professional development.